inaction |

demographics |

“One of America’s most important institutions – a symbol of the trust between generations – is also in need of wise and effective reform. Social Security was a great moral success of the 20th Century, and we must honor its great purposes in this new century. The system, however, on its current path, is headed toward bankruptcy. And so we must join together to strengthen and save Social Security.”

President George W. Bush State of the Union Address February 2, 2005

A Social Security System designed for a 1935 world does not fit the needs of the 21st Century. Social Security was designed in 1935 for a world that is very different from today. In 1935, most women did not work outside the home. Today, about 60% of women work outside the home. In 1935, the average American did not live long enough to collect retirement benefits. Today, life expectancy is 77 years. (2004 Report of the Social Security Trustees, p. 81).

Social Security will not be changed for those 55 or older (born before 1950).Today, more than 45 million Americans receive Social Security benefits and millions more are nearing retirement. For these Americans, Social Security benefits are secure and will not change in any way.

Social Security is making empty promises to our children and grandchildren. For our younger workers, Social Security has serious problems that will grow worse over time. Social Security cannot afford to pay promised benefits to future generations because it was designed for a 1935 world in which benefits were much lower, life-spans were shorter, there were more workers per retiree, and fewer retirees were drawing from the system.

With each passing year, there are fewer workers paying ever-higher benefits to an ever-larger number of retirees. Social Security is a pay-as-you-go system, which means taxes on today’s workers pay the benefits for today’s retirees. A worker’s payroll taxes are not saved in an account with his or her name on it for the worker’s retirement.

• There are fewer workers to support our retirees. When Social Security was first created, there were 40 workers to support every one retiree, and most workers did not live long enough to collect retirement benefits from the system. Since then, the demographics of our society have changed

dramatically. People are living longer and having fewer children. As a result we have seen a dramatic change in the number of workers supporting each retiree’s benefits. According to the 2004 Report of the Social Security Trustees (page 47):

In 1950, there were 16 workers to support every one beneficiary of Social Security.

Today, there are only 3.3 workers supporting every Social Security beneficiary.

And, by the time our youngest workers turn 65, there will be only 2 workers supporting each beneficiary.

• Benefits are scheduled to rise dramatically over the next few decades. Because benefits are tied to wage growth rather than inflation, benefits are growing faster than the rest of the economy. This benefit formula was established in 1977. As a result, today’s 20-year old is promised benefits that are 40% higher, in real terms, than are paid to seniors who retire this year. But the current system does not have the money to pay these promised benefits.

• The retirement of the Baby Boomers will accelerate the problem. In just 3 years, the first of the Baby Boom generation will begin to retire, putting added strain on a system that was not designed to meet the needs of the 21 century. By 2031, there will be almost twice as many older Americans as today – from 37 million today to 71 million. (ssa.gov/pressoffice/basicfact).

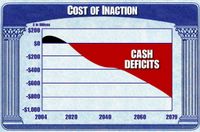

Social Security is heading toward bankruptcy. According to the Social Security Trustees, thirteen years from now, in 2018, Social Security will be paying out more than it takes in and every year afterward will bring a new shortfall, bigger than the year before. And, when today’s young workers begin to retire in 2042, the system will be exhausted and bankrupt. (Summary of the 2004 Annual Report of the Social Security Trustees, p. 1). If we do not act now to save it, the only solution will be drastically higher taxes, massive new borrowing, or sudden and severe cuts in Social Security benefits or other government programs.

As of 2004, the cost of doing nothing to fix our Social Security system had hit an estimated $10.4 trillion, according to the Social Security Trustees. (2004 Report of the Social Security Trustees, p. 58). The longer we wait to take action, the more difficult and expensive the changes will be.

• $10.4 trillion is almost twice the combined wages and salaries of every working American in 2004.

• Every year we wait costs an additional $600 billion. (2004 Report of the Social Security Trustees, p. 58).

• Today’s 30-year-old worker can expect a 27% benefit cut from the current system when he or she reaches normal retirement age. (2004 Report of the Social Security Trustees, p. 8). And, without action, these benefit cuts will only get worse.

View entire document in PDF format: Strengthening Social Security for the 21st Century SOURCE: whitehouse.gov

No comments:

Post a Comment