Technorati Tags: President Bush and White House or Line-Item Veto and Manhattan Institute or Congress and Office of Management and Budget or Rob Portman and Senate Appropriations Committee or Senate Budget Committee and VIDEO or small business and Congressional Research Service or budgetary reform program

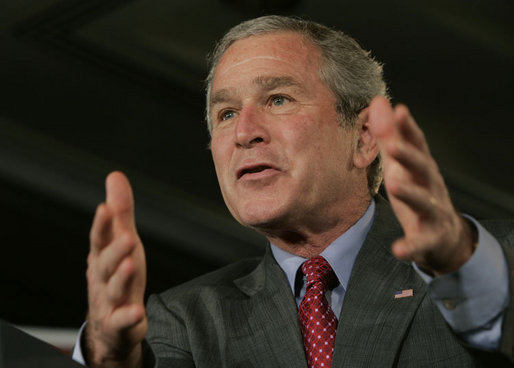

President Discusses Line-Item Veto, FULL STREAMING VIDEO, JW Marriott Hotel, Washington, D.C. 10:58 A.M. EDT. Fact Sheet: The Legislative Line-Item Veto: Constitutional, Effective, and Bipartisan

I want to talk about our economy. I want to talk about ways that we can -- the executive branch can work with the Congress to convince the American people we're being wise about how we spend our money. One of the things I want to assure you is that I believe that this country ought not to fear the future. I believe we ought to put good policy in place to shape the future. And by that I mean we shouldn't fear global competition. We shouldn't fear a world that is more interacted. We should resist temptations to protect ourselves from trade policies around the world. We should resist the temptation to isolate ourselves. We have too much to offer for the stability and peace and welfare of the world than to shirk our duties and to not accept an international community.

I know some in our country are fearful about our capacities to compete. I'm not. I believe that we can put policies in place that will make sure we remain the most entrepreneurial country in the world, that we're capable of competing in the world. And one way to do so is to keep pro-growth economic policies in place and be wise about how we spend the people's money. And that's what I want to talk about.

I do want to thank my Director of Office of Management and Budget, Rob Portman, who has joined us today. He has done a spectacular job as the person partially responsible for tearing down trade barriers and to making sure our nation was treated fairly in the trade arena when he was head of USTR. And now I've asked him to come over and manage OMB. It's a powerful position. The person who knows how the money is being spent is generally the person who's got a lot of influence in government. So I put a good friend in there to make sure we're able to work with the Congress to bring some fiscal austerity to the budget.

I want to thank Senator Thad Cochran, who is the Chairman of the Senate Appropriations Committee. It's awfully generous of the Senator to be here today. He's a good fellow and a fine United States Senator, and we're proud to have him in our midst.

I want to thank Senator Judd Gregg, who's the Chairman of the Senate Budget Committee. I've known Judd a long time. I've had to -- when I was running for president I was asked to debate my opponent a couple of times, and one of the things you do prior to debating your opponent is you have somebody serve as the opponent, and that happened to be Judd Gregg in both elections. (Laughter.) And I had to kind of reconcile myself with the fact that he whipped me in -- every time we debated. (Laughter.) He's a good man who's just introduced some interesting ideas on to the floor of the United States Senate about how to deal with some of the fiscal problems and financial problems this nation faces.

I'm proud to be here with John McCain -- speaking about debates -- (laughter) -- we had a few. But one thing we agree upon is that this country needs to have a line-item veto. And I'm proud the Senator is here and I appreciate you coming. (Applause.) I might add, one of the many things we agree upon.

I'm proud to be here with Congressman Paul Ryan, who's the House bill sponsor of the line-item veto, as well as Congressman Mark Udall. Thank you both for being here. Congratulations on getting that bill out of the United States House of Representatives. I'm also honored that Congressman Mike Castle, Congresswoman Marilyn Musgrave, and Congressman Henry Cuellar from the great state of Texas, has joined us. Thank you all for coming. (Applause.)

For those of you who are working the halls of Congress to get a line-item veto out, thanks for doing what you're doing. One of the reasons I've come to give you a speech on the line-item veto is to encourage you to continue working hard with members of both political parties to get the job done.

We're growing. This economy of ours is strong. And that's good news. It's amazing where we've come from, if you really think about it. We've been through a recession; we've been through a stock market correction; we've been through corporate scandals; we've been through an attack on our country; we've been through two major operations to defend the United States of America; and we've been through amazing natural disasters and high energy prices. And yet, we're growing. We're the envy of the industrialized world. The growth in the last year was 3.5 percent; it was 5.3 percent in the first quarter of this year. That's good news. It means the entrepreneurial spirit is strong, that people are investing and people are making wise decisions with their money. And as a result of the growing economy, the national unemployment rate is 4.6 percent. That's low. That means your fellow citizens are going to work. That means people are having a chance to put food on the table. And that's a positive indication of how strong our economy is.

We're a productive nation. Productivity is on the increase. That's a result of investments that are being made in the private sector. A productive economy is one that will yield higher wages for the American people. The more productive you are, the more likely it is your wages will go up, which means a higher standard of living for the American people. And I want to thank the Manhattan Institute's support for pro-growth economic policies, policies that really send a clear signal that we are still the land of dreamers and doers and risk-takers.

The cornerstone of our policy has been to keep taxes low, see. We believe, and you believe, that the more money a person has in their pocket, the more likely it is this economy is going to grow. We trust people to make the right decisions on how to spend, save, and invest. That's certainly not necessary -- necessarily the common policy here in Washington. There's some good and decent folks who think they can spend your money better than you can. I just don't agree with them. And one of the reasons why this economy is strong is because we cut the taxes on everybody who pays taxes in the United States. If you have a child, you got extra money. If you're married, we did something about the marriage penalty. It doesn't make any sense, by the way, to penalize marriage. Society ought to be encouraging marriage.

If you're an investor, you got tax relief because we cut the taxes on the dividends and capital gains. If you're a small business, it's likely that you pay taxes at the individual income tax rate because you're more likely than not to be a sole proprietorship or a Sub-chapter S corporation. Seventy percent of new jobs in America are created by small business, and it made sense to let our small business entrepreneurs keep more of their own money to save and invest and expand their businesses. The tax relief we passed is working, and the Congress needs to make the tax relief we passed permanent. (Applause.)

One of the benefits of keeping taxes low and growing your economy is that you end up with more tax revenues in the federal treasury. I know that seems counterintuitive to some people. You'll hear people say, let's balance the budget by raising taxes. By the way, that's not the way Washington works. They'll raise your taxes and figure out new ways to spend your money.

It turns out that when you encourage economic vitality and growth, the treasury benefits from it. In 2005, tax revenues grew by almost $274 billion, or 15 percent. That's the largest increase in 24 years. The economy is continuing to grow, and tax revenues are growing with it. So far this year, tax revenues are more than 11 percent higher than they were at the same point last year, which is significantly better than projected. These increased tax revenues are part of how we intend to cut the deficit in half by 2009. In other words, Rob Portman will be giving a report to the nation on how we're doing on the tax revenues -- I think you're going to find that pro-growth economic policies mean that more revenues are coming into the Treasury than anticipated, which makes it easier to deal with a current account budget deficit.

But there's a second part of the equation to dealing with the current account budget deficit and that is how we spend your money. Now, I'm going to talk about discretionary spending in a minute, but I just want you to understand that a significant problem we face is in our mandatory programs. And I know you know that. Those would be programs called Medicare and Social Security and Medicaid.

As you might recall, I addressed that issue last year, focusing on Social Security reform. I'm not through talking about the issue. I spent some time today in the Oval Office with the United States senators, and they're not through talking about the issue either. It's important for this country -- (applause) -- I know it's hard politically to address these issues. Sometimes it just seems easier for people to say, we'll deal with it later on. Now is the time for the Congress and the President to work together to reform Medicare and reform Social Security so we can leave behind a solvent balance sheet for our next generation of Americans. (Applause.)

If we can't get it done this year, I'm going to try next year. And if we can't get it done next year, I'm going to try the year after that, because it is the right thing to do. It's just so easy to say, let somebody else deal with it. Now is the time to solve the problems of Medicare and Social Security, and I want your help. I need the Manhattan Institute to continue to agitate for change and reform. You've got a big voice. You got creative thinkers, and if you don't mind, I'd like to put this on your agenda, and let you know the White House and members of the Senate and the House are anxious to deal with this issue and get it done once and for all.

In the meantime, we've got to do everything we can to control the spending that Congress votes on and approves every year. That's called discretionary spending. My administration is doing its part on discretionary spending. Every year since I took office, we've reduced the growth of discretionary spending that is not related to the military or homeland security. And the reason why we haven't reduced the growth on spending for the military is because so long as we've got troops in harm's way, they're going to have whatever it takes to win the war on terror. (Applause.)

We will not short-change the people who wear the uniform of the United States military. As the Commander-in-Chief of this fine group of men and women, I have got to be able to look in the eyes of their loved ones and say, one, the mission is worth it; and two, this government and the people of the United States support your loved ones with all we got. And that's exactly how I'm going to continue to conduct this war on terror. (Applause.)

But apart from defending our country, the last two budgets have cut non-security discretionary spending -- have cut the non-security discretionary spending. And that's not easy. It's not easy to do that, but the Congress delivered, at least on last year's appropriations bills. And they're working on this year's appropriations bills. Our view is, taxpayers' dollars should be spent wisely or not at all. One of Rob Portman's jobs is to analyze programs that are working, or not working. Look, every program sounds good, I know. But we're focusing on the results of the programs, are they achieving the objectives that we expect.

One of the first tests of this year on whether or not the administration can work with the Congress on fiscal restraint was on a supplemental spending bill. That's a bill that was passed to provide emergency spending for our troops overseas, and for citizens that had been hit by Katrina, and to prepare for the dangers of a pandemic flu. I felt those were important priorities that needed to be a part of the supplemental bill, and so we sent that bill up.

Obviously, there was some noise coming out of the Congress at first; people had different opinions. And that's a good thing about democracy -- you'll find there's all kinds of different opinions here in Washington, D.C. People had different views about what ought to be in that bill. Part of my job is to help bring some fiscal discipline to Washington. So I said that if the Congress exceeded a limit that I thought was wise, I would veto the bill. Congress acted responsibly. And it was hard work, and I applause Senator Cochran for his hard work on this measure. He brought the House together with the Senate, and they took out $15 billion in spending that had been added to the bill. It came under the spending limit I had set. And it's a good example of fiscal restraint set by the Congress. I appreciate so very much your leadership on that issue, Mr. Chairman. Thanks for working with us.

I believe another crucial test for the Congress is to whether or not the Congress will pass a line-item veto. And that's what I want to talk to you about today. A line-item veto would be a vital tool that a President could use to target spending that lawmakers tack on to the large spending bills. That's called earmarking, and that's become quite a controversial subject here in Washington, D.C.

I happen to believe that a lot of times earmarking results in unnecessary spending. See, part of the job of the President and the leaders in the Congress is to set priorities with the people's money. If you don't set priorities, the tendency is to overspend. And sometimes -- a lot of times, the earmark doesn't fit into the priorities that have been sent through the budgetary process. A lot of times earmarks are inserted into bills at the last minute, which leaves no time, or little time, for debate. Part of the process -- a good process is one in which members are able to debate whether or not spending meets a priority, whether it makes sense. Earmark sponsors are often not required to provide their colleagues with a reasoned justification for proposed spending. And not surprisingly, the process often results in spending that would not have survived had it not been subject -- subjected to closer scrutiny. Part of a good legislative process is for members to take a good look at whether or not a spending request meets a priority or not.

And the process has changed. According to the Congressional Research Service, the number of earmarks has increased from about 3,000 to 13,000 over the last decade. In other words, this process is taking place more and more often. I don't think that's healthy for the process. Matter of fact, I think it's circumventing the process. Now, that's up -- obviously, up for the legislature to determine whether I'm right or not. The President proposes, and the legislative body disposes, and I'm proposing a way to help deal with this problem. And that way is to pass a line-item veto.

Now, here's why it's necessary. First of all, part of the problem with the line-item veto is that it's oftentimes deemed to be unconstitutional. As a matter of fact, I know there are people in this room that helped pass the line-item veto in 1996. President Clinton was the President then, and the Congress -- in my judgment -- wisely gave him the line-item veto. And yet, shortly thereafter, when he started using the line-item veto, the Supreme Court struck it down because they concluded that it unconstitutionally permitted the President to unilaterally change a law passed by the Congress. In other words, the bill didn't pass constitutional muster.

And so we dealt with this issue. We figured out that, obviously, any line-item veto would again be challenged to our highest court. And so we proposed the following type of legislation: When the President sees an earmark or spending provision that is wasteful or unnecessary, he can send it back to the Congress. And Congress is then required to hold a prompt up or down vote on whether to retain the targeted spending. In other words, the Congress is still in the process.

The line-item veto submitted would meet the Court's constitutional requirements. And that's important. Members of Congress need to know that we've thought carefully about this, and we've worked with them to make sure that that which is passed is constitutional.

The other thing the line-item veto needs to do is it will shine the light of day on spending items that get passed in the dark of the night, and that will have -- in my judgment -- a healthy -- it will send a healthy signal to the people that we're going to be wise about how we spend their money.

The bill I submitted will be an effective tool for restraining government spending because it will address a central dilemma created by unwarranted earmarks. And here's the dilemma: When members of Congress are faced with an important bill that includes wasteful spending in the bill, they have two bad options: On the one hand, they can vote against the whole bill, including the worthwhile spending, or they can vote for the whole bill, including the wasteful spending. When such a bill comes to the President it creates a dilemma. I've negotiated year after year on a top-line budget number. And Congress has met that top-line budget number, which means it's very difficult for the President, then, to veto the appropriations bills that have met the top-line budget number because the next year's budget negotiations will be meaningless. You can imagine members of the United States House or Senate walking into the President's office and saying, wait a minute, we met your number last year, and you vetoed the bill, so forget negotiations.

I want to be a part of the budgetary process. It's an important part of the President's working with Congress, and I'm not going to deal myself out of the budgetary process. So my point is, they can meet the size of the pie, but I may not like some of the slices of the pie. And therefore, what do we do about it? And one way to deal with it is the line-item veto. The President could approve the spending that is necessary, could red-line spending that is not, and then let the Congress decide whether or not the President is right. It's a fair process; I believe it's a necessary process.

Many members in Congress, I know, want to do the right thing. And so one of the interesting things about the line-item veto is it will help deal with that dilemma I described, either all or nothing when it comes to voting for appropriations bills. You know, sometimes a member of Congress gets a special project for the district, and they go back and tout the project. Then you have members who don't agree with earmarking, and they don't have any special project to tout to the district. And yet, the people in their district are voting for the special project for the other person's district. And I think the line-item veto -- I know the line-item veto would help resolve this dilemma.

You see, if there's an opportunity for the President to red-line certain programs and hold them up to the light of day, it will probably mean members of Congress are less likely to propose the earmarks in the first place. Rather than being able to move a special project into the bill without hearing, this -- the President would have the opportunity to say, wait a minute, this doesn't make much sense, it doesn't seem to fit into the priorities; this special project, this unusual study -- (laughter) -- or this particular project, this doesn't make sense.

I believe that part of a budgetary reform program is the line-item veto, the opportunity to put the light on such programs. And that will help members resolve the dilemma of either voting for an important bill with bad items in it, or being a part of trying to put bad items in it in order to justify their existence in the Congress.

The good thing about the line-item veto, it has bipartisan support. We've got a Democrat member from the United States Congress who supported that bill strongly. Governors have had the line-item veto. I met with Senator Ben Nelson earlier this morning in the Oval Office -- he talked about what an effective tool it was to have the line-item. Did you have it, Engler, when you were governor? Engler had it. It's an important part of relating with the legislative process. And by the way, these aren't just Republican governors with the line-item veto, they're Democrat and Republican governors who are using that line-item veto effectively.

The line-item veto has bipartisan support in the Congress. Thirty-five Democrats joined more than 200 Republicans in the House to get the bill passed. That's a good sign. I was disappointed, frankly, though, that more Democrats didn't vote for the bill, especially those who are calling for fiscal discipline in Washington, D.C. I mean, you can't call for fiscal discipline on the one hand, and then not pass a tool to enhance fiscal discipline on the other hand. You can't have it both ways, it seems like to me.

Now the Senate is going to take up the measure. And again, I want to thank the Senators who are here for strategizing on how we can get the bill moving. Senator Frist is committed to getting the bill moving. Senator McCain is one of the important co-sponsors, as is Senator John Kerry. I remember campaigning against him in 2004, and I remember him talking about the line-item veto, and I appreciate the fact that he's living up to the political promises he made. It's a good sign, and I applaud Senator Kerry for taking the lead on the line-item veto. And I hope members of his party listen to his justifications for that important piece of legislation.

What's really interesting is, we've had senators on record for the line-item veto. After all, the Senate passed a line-item veto in 1996. And for those senators who passed the line-item veto in 1996, I hope they still consider it an important vote in 2006. Ten years hasn't made that big a difference. It was good enough 10 years ago, it's good enough today, for those who voted for the line-item veto. (Applause.)

Oh, I know this town is full of all kinds of politics, but we ought to set politics aside. We need to set politics aside when it comes to reforming Social Security and Medicare, and we need to set politics aside so that the President can work with the Congress to bring fiscal discipline to our budgets. That's what the taxpayers expect from those of us who are honored to serve.

So that's my opinion on the line-item veto. I hope you can feel -- tell I feel strongly about it. I think it makes sense, no matter who the President may be. I think it makes sense for a Republican President to have a line-item veto, and I think it makes sense for a Democrat President to have a line-item veto. And I urge the United States Senate to pass this important legislation so we can reconcile whatever differences there are between the House and the Senate version, and show the people that we are serious about being responsible with their money.

Thanks for letting me come by and say hello. (Applause.)

END 11:26 A.M. EDT For Immediate Release, Office of the Press Secretary, June 27, 2006

RELATED: Keywords Federal Reserve, Wednesday, May 10, 2006 Federal Open Market Committee Statement 05/10/06, Tuesday, March 28, 2006 Federal Open Market Committee Statement 03/28/06, Wednesday, February 15, 2006 Chairman Ben S. Bernanke, Semiannual Monetary Policy Report, Monday, February 06, 2006 President Attends Swearing-In Ceremony for Federal Reserve Chairman Ben Bernanke VIDEO, Monday, October 24, 2005 Appointment Ben Bernanke Federal Reserve (VIDEO), Monday, October 24, 2005 Biography of Dr. Ben S. Bernanke, Tuesday, June 21, 2005 President Congratulates CEA Chairman Ben Bernanke (VIDEO)

RELATED: Keywords, John Snow, Friday, June 23, 2006 Terrorist Finance Tracking Program (VIDEO), Tuesday, May 30, 2006 President Nominates Henry Paulson for Treasury (VIDEO), Thursday, May 18, 2006 President Signs Tax Relief Extension Reconciliation Act of 2005, Thursday, March 09, 2006 President Signs USA PATRIOT Act (VIDEO), Thursday, March 17, 2005 President's Statement on World Bank and Paul Wolfowitz, Sunday, March 13, 2005 Treasury Department Launches Social Security Web Site,

No comments:

Post a Comment