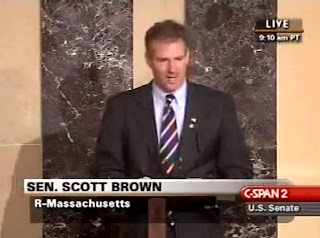

WASHINGTON, DC – Today, U.S. Senator Scott Brown (R-MA) introduced his "Immediate Tax Relief for America's Workers" Amendment on the floor of the U.S. Senate. Below are his remarks as prepared for delivery.

Mr. President, families in Massachusetts, and across this great nation, are suffering during these tough economic times. One year after this Congress passed the stimulus package, Americans are still struggling to pay their bills, save money for college, or buy groceries to put on their kitchen tables.

But in Washington, the federal government is driving up our debt and creating government waste on projects that don’t create private sector jobs or provide immediate relief for American workers.

The hundreds of billions we spent, and continue to spend, on the stimulus package have not created one new net job.

Most Americans believe that Washington is not using this money effectively enough, especially while many Americans are suffering and needing immediate and real relief.

In fact, the federal government is sitting on roughly $80 billion of so-called “stimulus” funds that are either unused or unobligated to specific projects as of this date. That’s $80 BILLION in taxpayer money – stuck in a virtual Washington slush fund potentially used for special interest or so-called “pork” projects.

Mr. President – it’s time to put this money back to work and back into the pockets of the hardworking American families – so they get the help they need, provide for their families, save for their future, and put real money back into the struggling economy.

Providing immediate across-the-board tax relief to working families is not complicated economic policy – it’s simple and common economic sense.

Leaders on both sides of the political aisle – from Presidents John F. Kennedy to Ronald Reagan – have taught us that the best way to get our economy moving again is by returning money directly to the American people.

I believe that the individual citizen knows better how to spend their own money than the federal government does.

The “Immediate Tax Relief for American Workers” amendment would cut payroll taxes and provide across-the-board tax relief for almost 130 million American workers.

That number again, Mr. President – 130 MILLION people in the American work force, including more than 3 million in my home state of Massachusetts.

130 million workers would receive immediate and direct tax relief. By turning the estimated $80 billion dollars in unobligated stimulus accounts over to the American people, our workers could see their payroll taxes lowered by nearly $100 per month, saving them more than $500 over a six month period.

Working couples could receive a tax cut worth more than $1000.

Now, some people or groups in Washington might not think that is a lot of money – but families in Massachusetts, and across the country, know what a dollar is worth. For most American families, $100, $500 – and $1000 – is a lot of money that will help during tough times – pay for oil, food, medical bills or everyday basic needs.

The American people need this relief, Mr. President, they deserve this.

Families would immediately get the help they need to pay their bills – provide for their families – and put real money back into the economy, helping spark a true recovery.

And unlike tax cuts of years past, this one will be paid for entirely. It will not increase the deficit and could be implemented in about 60 days.

It would be paid for using the roughly $80 billion dollars in unused and unobligated stimulus funds that is currently sitting in a slush-fund in Washington D.C. – doing nothing to stimulate our struggling economy.

To not do this, Mr. President, would be a mistake and a disservice to the people who pay the bills – the US taxpayers.

Let me be clear -- my amendment would not add one penny to our federal deficit.

And let me remind my colleagues in this chamber – Bipartisanship is a two-way street.

Last week, I crossed party lines without hesitation to support a bill that would put people back to work in Massachusetts and throughout the country. I took some heat for it, but held firm and looked at the bill with open eyes – it wasn’t perfect, but it was a good first start.

As I have said before, when I see a good idea, I will support it, whether it comes from a Republican or a Democrat, and the American people have made it clear they expect the same from their elected officials.

So now, here is our chance to show the American people that the partisan bickering is over. We can help people now.

With so many American families struggling – now is not the time for political gamesmanship. It is time to do the people’s business and we CAN do better!

When the “Immediate Tax Relief for America’s Workers” amendment comes to a vote – my colleagues have a very clear choice…. Support a measure that will immediately put money back into the pockets of all of your hardworking constituents.

OR – you can support business-as-usual in Washington – and leave the $80 Billion in unused stimulus funds in a Washington slush-fund – that will just create more bureaucracy and fewer private sector jobs in the years to come. The choice is pretty clear.

I would hope that my colleagues on both sides of the aisle would come together to support this common sense measure and not use procedural points of order to delay action on the economic emergency facing America’s workers. This amendment will help hardworking families – and boost our struggling economy.

After all, that is what we were sent here to do.

Thank you Mr. President. I yield back the balance of my time. ###

No comments:

Post a Comment