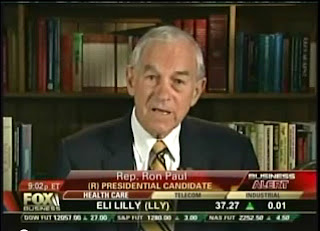

Ron Paul at Tea Party Patriots American Policy Summit 02/26/11 VIDEO Afternoon Session 1:00 PM Sat, Feb 26

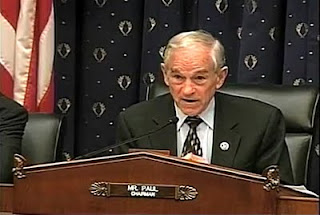

Subcommittee on Domestic Monetary Policy “Can Monetary Policy Really Create Jobs?” Hearing Date: February 9, 2011 Chairman Ron Paul Statement for the Record

| For the past three decades, the Federal Reserve has been tasked with a dual mandate: keeping prices stable and maximizing employment. Influenced by Keynesian economics and the supposed tradeoff between inflation and unemployment, the dual mandate relies on the idea that a handful of experts can successfully steer the American economy and create economic growth. This has forced upon us an interventionist monetary policy that believes that creation of money out of thin air is the cure for all that ails us. |

This policy relies not only on the fatal conceit of believing in the wisdom of supposed experts, but also on numerical chicanery. Rather than understanding inflation in the classical sense as a monetary phenomenon-- an increase in the money supply- it has been redefined as an increase in the Consumer Price Index (CPI). The CPI is calculated based upon a weighted basket of goods which is constantly fluctuating, allowing for manipulation of the index to keep inflation expectations low. Employment figures are much the same, relying on survey data, seasonal adjustments, and birth/death models, while the major focus remains on the unemployment rate. Of course, the unemployment rate can fall as discouraged workers drop out of the labor market altogether, leading to the phenomenon of a falling unemployment rate with no job growth.

In terms of keeping stable prices, the Fed has failed miserably. According to the government's own CPI calculators, it takes $2.65 today to purchase what cost one dollar in 1980. And since its creation in 1913, the Federal Reserve has presided over a 98% decline in the dollar's purchasing power. Recent news stories have offered numerous anecdotes of prices rising far faster than would be expected if official inflation figures were accurate. With commodities, oil, or food prices, speculation is that the Federal Reserve's quantitative easing is leading to hot money flooding world markets. The average American family sees the price of milk, eggs, and meat increasing, while packaged household goods decrease in size rather than price. People around the world are reacting against the specter of sharp price increases. While the focus of this hearing does not deal with inflation or even specifically with the dual mandate, this subcommittee undoubtedly will hold further hearings on these topics in the future.

Today's hearing focuses on jobs, and the inability of the Federal Reserve's monetary policy to create jobs or to achieve maximum employment. The stagflation of the 1970s should have taught us this lesson already The Federal Reserve's loose monetary policy, rather than leading to a tradeoff between jobs and inflation, instead led to both high inflation and high unemployment. Hopefully we will learn the lesson this time around.

Of course loose fiscal policy has failed to create jobs too. Consider that we had a $700 billion TARP program, nearly $1 trillion in stimulus spending, a government takeover of General Motors, and hundreds of billions of dollars of guarantees to Fannie Mae, Freddie Mac, HUD, FDIC, etc. On top of those programs the Federal Reserve has provided over $4 trillion worth of assistance over the past few years through its credit facilities, purchases of mortgage-backed securities, and now its second round of quantitative easing. Yet even after all these trillions of dollars of spending and bailouts, total nonfarm payroll employment is still seven million jobs lower than it was before this crisis began. Since employment levels bottomed out last year, the government reports that roughly one million jobs have been created. This means that each job created has cost upwards of five million dollars. We probably would have been better off just printing out these trillions of dollars and throwing them out the window of a helicopter.

In this same period of time that we lost seven million jobs, the total U.S. population has increased by nine million people. We would expect that roughly four million of these people should have been employed, so we are really dealing with eleven million fewer employed people than would otherwise be expected. Let us put this figure in perspective. Eleven million people represents almost the population of Ohio, a figure greater than the population of 43 of the 50 states. Eleven million people is twice as many people as are currently employed in construction, 45% more people than are currently employed in financial activities, and almost as many people as are currently employed in manufacturing.

Unfortunately, numbers like these are often ignored or overlooked. Everyone pays attention to the unemployment rate, which has just recently declined. Part of this is due to discouraged workers who have given up looking for work and have taken themselves out of the labor force, but the employment numbers are rigged in such a way as to make it look as though the employment situation is improving.

Another curious anomaly in employment data relates to seasonal adjustments. Seasonal variations are understandable-- for instance workers hired for the Christmas season and laid off immediately afterward. But such statistical adjustments are easy to manipulate. When unemployment figures were released in February of 2010, non-seasonally adjusted figures showed an additional 1.4 million unemployed workers from December 2009 to January 2010, while the seasonally adjusted numbers showed 69,000 fewer unemployed. The most recent figures released in February of 2011 showed an additional 3.1 million unemployed workers from December 2010 to January 2011, yet the seasonal adjustment shows 367,000 fewer unemployed. Spinning a 22% increase in the number of unemployed workers into a statistical decrease should be met with a healthy dose of skepticism.

It should not be surprising that monetary policy is ineffective at creating jobs. For one thing, there are numerous other factors that affect employment, including taxes, labor laws, and other regulations that contribute to labor market rigidity and institutional unemployment. But it is the effects of monetary policy itself that cause the boom and bust of the business cycle that leads to swings in the unemployment rate.

By lowering interest rates through its loose monetary policy, the Fed spurs investment in long-term projects that would not be profitable at market-determined interest rates. The signal to businesses is that consumers are increasing savings and deferring consumption in order to consume more capital-intensive more in the future. If the Fed-mandated interest rate is in fact lower than the market interest rate, the reality is that consumer preferences between consumption and savings have not changed, but businesses act as though they have. The result of lower interest rates is an economic boom which manifests itself as a bubble.

Everything seems to go well for awhile until businesses realize that they cannot sell their newly-built houses, their inventories of iron ore, or their new cars. Low interest rates have spurred production, but because the low interest rates resulted from Fed intervention and not through changes in consumption patterns, the result is overcapacity. Resources have been “malinvested,” directed into sectors of the economy which are not truly in demand from consumers. These resources must be liquidated, and this is the corresponding bursting of the bubble. Until these resources are redirected, often with great economic pain for all involved, true economic recovery cannot begin.

Labor is one of these resources that can be malinvested. As inflation rises due to the Fed's monetary intervention, real wage rates decrease, increasing the demand for labor and leading to lower unemployment. Sectors into which this new money flows see hiring increases, as we recently saw in financial services, mortgage lending, and construction during the housing boom. When the bust comes, however, these workers end up being laid off. They find it difficult to find employment in other industries due to an inability to sell their houses and move, or to retrain for a new skilled labor position, or for any number of other reasons. However the result of that initial meddling in monetary policy is an eventual increase in the unemployment rate.

We find ourselves now in the midst of the worst economic crisis in decades. Unemployment remains persistently high, and the United States cannot afford increased meddling by the Federal Reserve. Over $4 trillion in bailout facilities and outright debt monetization, combined with interest rates near zero for over two years, have not and will not contribute to increased employment. I shudder to think of what the Fed might do if the unemployment rate were to continue to increase.

By falsely diagnosing the cause of the crisis, the Fed's solution is fatally flawed. What is needed is liquidation of debt and of malinvested resources. Pumping money into the same sectors that have just crashed merely prolongs the crisis and ensures that the day of financial reckoning that eventually will come will be far more severe than otherwise. Until we learn the lesson that jobs are produced through real savings and investment and not through the creation of new money, we are doomed to repeat this boom and bust cycle.

VIDEO CREDIT:

12onPaulTEXT CREDIT:

Congressman Ron Paul Washington, DC 203 Cannon House Office Building Washington, DC 20515 Phone Number: (202) 225-2831

IMAGE CREDIT:

C-SPAN