Senator Brown would vote to extend the 2001 and 2003 Federal tax cuts, currently set to expire in 2010. These tax cuts provided relief for all by cutting taxes on income, capital gains and dividends, doubling the child care credit, eliminating the marriage penalty and phasing out the death tax. Without an extension, many Americans will see a massive tax increase in 2011. Senator Brown understands that taxes need to be kept low so people can keep more of their money to spend or to save as they choose, especially now when many families are hurting.

Senator Brown proposes lowering the corporate tax rate. Senator Brown recognizes that American companies must stay competitive to allow our economy to remain the job-creating engine and economic driver of the world. At 39 percent, the United States is tied with Japan for the world’s highest corporate tax rate. Making America’s business environment competitive with the rest of the world will attract capital, encourage investment and create new jobs.

Senator Brown supports lower taxes for individuals and families. Reducing marginal tax rates across the board will reward productivity and allow people to keep more of their own money. By leaving more money in the economy for consumption and investment, the private sector will respond with more jobs and higher salaries for workers.

Senator Brown has signed the no-tax pledge. Senator Brown is the only candidate in the race who has signed the Americans for Tax Reform pledge not to raise taxes on the American people.

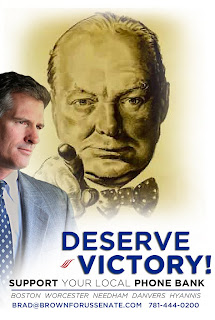

Scott Brown for U.S. Senate Committee. 200 Reservoir Street, Needham, MA 02494 | info@brownforussenate.com | 781-444-0200

No comments:

Post a Comment