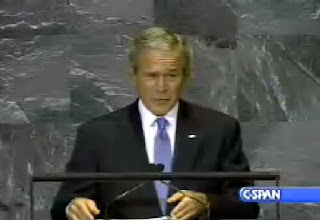

President George W. Bush is welcomed by United Nations U.S. Ambasador Dr. Zalmay Khalilzad as he arrives Monday, Sept. 22, 2008, aboard Marine One at the Wall Street helicopter landing area in New York City. President Bush addressed the United Nations General Assembly on Tuesday Sept.23, 2008. White House photo by Eric Draper.  President Bush makes his speech to the United Nations when the General Assembly opened today. Later in the day, he met with U.N. Sec. General Ban Ki Moon and the Iraq Coalition. | President Bush Addresses United Nations General Assembly, FULL STREAMING VIDEO, United Nations Headquarters New York, New York. In Focus: Global Diplomacy 10:12 A.M. EDT. THE PRESIDENT: Mr. Secretary General, distinguished delegates, ladies and gentlemen: I'm pleased to be here to address the General Assembly. Sixty-three years ago, representatives from around the world gathered in San Francisco to complete the founding of the Charter of the United Nations. They met in the shadow of a devastating war, with grave new dangers on the horizon. They agreed on a historic pledge: "to reaffirm faith in fundamental human rights, and unite their strength to maintain international peace and security." This noble pledge has endured trying hours in the United Nations' history, and it still guides our work today. Yet the ideals of the Charter are now facing a challenge as serious as any since the U.N.'s founding -- a global movement of violent extremists. |

To uphold the words of the Charter in the face of this challenge, every nation in this chamber has responsibilities. As sovereign states, we have an obligation to govern responsibly, and solve problems before they spill across borders. We have an obligation to prevent our territory from being used as a sanctuary for terrorism and proliferation and human trafficking and organized crime. We have an obligation to respect the rights and respond to the needs of our people.

Multilateral organizations have responsibilities. For eight years, the nations in this assembly have worked together to confront the extremist threat. We witnessed successes and setbacks, and through it all a clear lesson has emerged: The United Nations and other multilateral organizations are needed more urgently than ever. To be successful, we must be focused and resolute and effective. Instead of only passing resolutions decrying terrorist attacks after they occur, we must cooperate more closely to keep terrorist attacks from happening in the first place. Instead of treating all forms of government as equally tolerable, we must actively challenge the conditions of tyranny and despair that allow terror and extremism to thrive. By acting together to meet the fundamental challenge of our time, we can lead toward a world that is more secure, and more prosperous, and more hopeful.

In the decades ahead, the United Nations and other multilateral organizations must continually confront terror. This mission requires clarity of vision. We must see the terrorists for what they are: ruthless extremists who exploit the desperate, subvert the tenets of a great religion, and seek to impose their will on as many people as possible. Some suggest that these men would pose less of a threat if we'd only leave them alone. Yet their leaders make clear that no concession could ever satisfy their ambitions. Bringing the terrorists to justice does not create terrorism -- it's the best way to protect our people.

Multilateral organizations must respond by taking an unequivocal moral stand against terrorism. No cause can justify the deliberate taking of innocent human life -- and the international community is nearing universal agreement on this truth. The vast majority of nations in this assembly now agree that tactics like suicide bombing, hostage-taking and hijacking are never legitimate. The Security Council has passed resolutions declaring terror unlawful and requiring all nations to crack down on terrorist financing. And earlier this month, the Secretary General held a conference to highlight victims of terror, where he stated that terrorism can never be justified.

Other multilateral organizations have spoken clearly, as well. The G8 has declared that all terrorist acts are criminal and must be universally condemned. And the Secretary General of the Organization of the Islamic Conference recently spoke out against a suicide bombing, which he said runs counter to the teachings of Islam. The message behind these statements is resolutely clear: Like slavery and piracy, terrorism has no place in the modern world.

Around the globe, nations are turning these words into action. Members of the United Nations are sharing intelligence with one another, conducting joint operations, and freezing terrorist finances. While terrorists continue to carry out attacks like the terrible bombing in Islamabad last week, our joint actions have spared our citizens from many devastating blows.

With the brutal nature of the extremists increasingly clear, the coalition of nations confronting terror is growing stronger. Over the past seven years, Afghanistan and Iraq have been transformed from regimes that actively sponsor terror to democracies that fight terror. Libya has renounced its support for terror and its pursuit of nuclear weapons. Nations like Saudi Arabia and Pakistan are actively pursuing the terrorists. A few nations -- regimes like Syria and Iran -- continue to sponsor terror. Yet their numbers are growing fewer, and they're growing more isolated from the world.

As the 21st century unfolds, some may be tempted to assume that the threat has receded. This would be comforting; it would be wrong. The terrorists believe time is on their side, so they made waiting out civilized nations part of their strategy. We must not allow them to succeed. The nations of this body must stand united in the fight against terror. We must continue working to deny the terrorists refuge anywhere in the world, including ungoverned spaces. We must remain vigilant against proliferation -- by fully implementing the terms of Security Council Resolution 1540, and enforcing sanctions against North Korea and Iran. We must not relent until our people are safe from this threat to civilization.

To uphold the Charter's promise of peace and security in the 21st century, we must also confront the ideology of the terrorists. At its core, the struggle against extremists is a battle of ideas. The terrorists envision a world in which religious freedom is denied, women are oppressed, and all dissent is crushed. The nations of this chamber must present a more hopeful alternative -- a vision where people can speak freely, and worship as they choose, and pursue their dreams in liberty.

Advancing the vision of freedom serves our highest ideals, as expressed in the U.N.'s Charter's commitment to "the dignity and worth of the human person." Advancing this vision also serves our security interests. History shows that when citizens have a voice in choosing their own leaders, they are less likely to search for meaning in radical ideologies. And when governments respect the rights of their people, they're more likely to respect the rights of their neighbors.

For all these reasons, the nations of this body must challenge tyranny as vigorously as we challenge terror. Some question whether people in certain parts of the world actually desire freedom. This self-serving condescension has been disproved before our eyes. From the voting booths of Afghanistan, Iraq, and Liberia, to the Orange Revolution in Ukraine and the Rose Revolution in Georgia, to the Cedar Revolution in Lebanon and the Tulip Revolution in Kyrgyzstan, we have seen people consistently make the courageous decision to demand their liberty. For all the suggestions to the contrary, the truth is that whenever or wherever people are given the choice, they choose freedom.

Nations in these chambers have supported the efforts of dissidents and reformers and civil society advocates in newly free societies throughout the new United Nations Democracy Fund. And we appreciate those efforts. And as young democracies around the world continue to make brave stands for liberty, multilateral organizations like the United Nations must continue to stand with them.

In Afghanistan, a determined people are working to overcome decades of tyranny, and protect their newly-free society. They have strong support from all 26 nations of the NATO Alliance. I appreciate the United Nations' decision this week to renew the mandate for the International Security Assistance Force in Afghanistan. The United Nations is also an active civilian presence in Afghanistan, where experts are doing important work helping to improve education, facilitate humanitarian aid, and protect human rights. We must continue to help the Afghan people defend their young democracy -- so the Taliban does not return to power, and Afghanistan is never again a safe haven for terror.

In Iraq, the fight has been difficult, yet daily life has improved dramatically over the past 20 months -- thanks to the courage of the Iraqi people, a determined coalition of nations, and a surge of American troops. The United Nations has provided the mandate for multinational forces in Iraq through this December. And the United Nations is carrying out an ambitious strategy to strengthen Iraq's democracy, including helping Iraqis prepare for their next round of free elections. Whatever disagreements our nations have had on Iraq, we should all welcome this progress toward stability and peace -- and we should stand united in helping Iraq's democracy succeed.

We must stand united in our support of other young democracies, from the people of Lebanon struggling to maintain their hard-won independence, to the people of the Palestinian Territories, who deserve a free and peaceful state of their own. We must stand united in our support of the people of Georgia. The United Nations Charter sets forth the "equal rights of nations large and small." Russia's invasion of Georgia was a violation of those words. Young democracies around the world are watching to see how we respond to this test. The United States has worked with allies in multilateral institutions like the European Union and NATO to uphold Georgia's territorial integrity and provide humanitarian relief. And our nations will continue to support Georgia's democracy.

In this chamber are representatives of Georgia and Ukraine and Lebanon and Afghanistan and Liberia and Iraq, and other brave young democracies. We admire your courage. We honor your sacrifices. We thank you for your inspiring example. We will continue to stand with all who stand for freedom. This noble goal is worthy of the United Nations, and it should have the support of every member in this assembly.

Extending the reach of political freedom is essential to prevailing in the great struggle of our time -- but it is not enough. Many in this chamber have answered the call to help their brothers and sisters in need by working to alleviate hopelessness. These efforts to improve the human condition honor the highest ideals of this institution. They also advance our security interests. The extremists find their most fertile recruiting grounds in societies trapped in chaos and despair -- places where people see no prospect of a better life. In the shadows of hopelessness, radicalism thrives. And eventually, that radicalism can boil over into violence and cross borders and take innocent lives across the world.

Overcoming hopelessness requires addressing its causes -- poverty, disease, and ignorance. Challenging these conditions is in the interest of every nation in this chamber. And democracies are particularly well-positioned to carry out this work. Because we have experience responding to the needs of our own people, we're natural partners in helping other nations respond to the needs of theirs. Together, we must commit our resources and efforts to advancing education and health and prosperity.

Over the years, many nations have made well-intentioned efforts to promote these goals. Yet the success of these efforts must be measured by more than intentions -- they must be measured by results. My nation has placed an insistence on results at the heart of our foreign assistance programs. We launched a new initiative called the Millennium Challenge Account, which directs our help to countries that demonstrate their ability to produce results by governing justly, and fighting corruption, and pursuing market-based economic policies, as well as investing in their people. Every country and institution that provides foreign assistance, including the United Nations, will be more effective by showing faith in the people of the developing world -- and insisting on performance in return for aid.

Experience also shows that to be effective, we must adopt a model of partnership, not paternalism. This approach is based on our conviction that people in the developing world have the capacity to improve their own lives -- and will rise to meet high expectations if we set them. America has sought to apply this model in our Emergency Plan for AIDS Relief. Every nation that receives American support through this initiative develops its own plan for fighting HIV/AIDS -- and measures the results. And so far, these results are inspiring: Five years ago, 50,000 people in sub-Sahara Africa were receiving treatment for HIV/AIDS. Today that number is nearly 1.7 million. We're taking a similar approach to fighting malaria, and so far, we've supported local efforts to protect more than 25 million Africans.

Multilateral organizations have made bold commitments of their own to fight disease. The G8 has pledged to match America's efforts on malaria and HIV/AIDS. Through the Global Fund, many countries are working to fight HIV/AIDS, malaria, and TB. Lives in the developing world depend on these programs, and all who have made pledges to fight disease have an obligation to follow through on their commitments.

One of the most powerful engines of development and prosperity is trade and investment, which create new opportunities for entrepreneurs, and help people rise out of poverty, and reinforce fundamental values like transparency and rule of law. For all these reasons, many in these chambers have conducted free trade agreements at bilateral and regional levels. The most effective step of all would be an agreement that tears down trade barriers at the global level. The recent impasse in the Doha Round is disappointing, but that does not have to be the final word. I urge every nation to seize this opportunity to lift up economies around the world -- and reach a successful Doha agreement as soon as possible.

Beyond Doha, our nations must renew our commitment to open economies, and stand firm against economic isolationism. These objectives are being tested by turbulence in the global financial markets. Our economies are more closely connected than ever before, and I know that many of you here are watching how the United States government will address the problems in our financial system.

In recent weeks, we have taken bold steps to prevent a severe disruption of the American economy, which would have a devastating effect on other economies around the world. We've promoted stability in the markets by preventing the disorderly failure of major companies. The Federal Reserve has injected urgently-needed liquidity into the system. And last week, I announced a decisive action by the federal government to address the root cause of much of the instability in our financial markets -- by purchasing illiquid assets that are weighing down balance sheets and restricting the flow of credit. I can assure you that my administration and our Congress are working together to quickly pass legislation approving this strategy. And I'm confident we will act in the urgent time frame required.

The objectives I've laid out for multilateral institutions -- confronting terror, opposing tyranny, and promoting effective development -- are difficult, but they are necessary tasks. To have maximum impact, multilateral institutions must take on challenging missions. And like all of us in this chamber, they must work toward measurable goals, be accountable for their actions, and hold true to their word.

In the 21st century, the world needs a confident and effective United Nations. This unique institution should build on its successes and improve its performance. Where there is inefficiency and corruption, it must be corrected. Where there are bloated bureaucracies, they must be streamlined. Where members fail to uphold their obligations, there must be strong action. For example, there should be an immediate review of the Human Rights Council, which has routinely protected violators of human rights. There should be a stronger effort to help the people of Burma live free of the repression they have suffered for too long. And all nations, especially members of the Security Council, must act decisively to ensure that the government of Sudan upholds its commitment to address the violence in Darfur.

The United Nations is an organization of extraordinary potential. As the United Nations rebuilds its headquarters, it must also open the door to a new age of transparency, accountability, and seriousness of purpose.

With determination and clear purpose, the United Nations can be a powerful force for good as we head into the 21st century. It can affirm the great promise of its founding.

In the final days of the San Francisco Conference, the delegates negotiating the U.N. Charter received a visit from President Harry Truman. He acknowledged the enormous challenges they faced, and said success was only possible because of what he called an "unshakable unity of determination." Today the world is engaged in another period of great challenge. And by continuing to work together, that unshakable unity of determination will be ours. Together, we confront and defeat the evil of terrorism. Together, we can secure the Almighty's gift of liberty and justice to millions who have not known it. And together, we can build a world that is freer, safer, and better for the generations who follow.

Thank you. (Applause.)

END 10:34 A.M. EDT For Immediate Release, Office of the Press Secretary September 23, 2008

Tags: President Bush and United Nations General Assembly