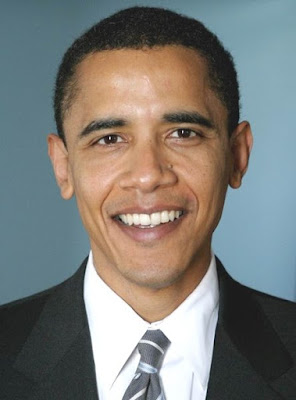

ARLINGTON, VA -- Today, McCain-Palin 2008 released its latest web ad, entitled "Ayers." The ad highlights Barack Obama's long-standing relationship with unrepentant domestic terrorist Bill Ayers. From his political introduction at Bill Ayers' house in 1995 to their service together on two boards, Barack Obama has long known Bill Ayers but has not been straightforward with the American people. This is an issue of judgment and candor and Barack Obama has not told the American people the truth.

Transcript For "Ayers" (WEB :90)

ANNCR: Barack Obama and domestic terrorist Bill Ayers. Friends. They've worked together for years.

But Obama tries to hide it. Why?

Obama launched his political career in Ayers' living room.

Ayers and Obama ran a radical "education" foundation, together.

They wrote the foundation's by-laws, together.

Obama was the foundation's first chairman.

Reports say they, "distributed more than $100 million to ideological allies with no discernible improvement in education."

When their relationship became an issue, Obama just responded, "This is a guy who lives in my neighborhood."

That's it?

We know Bill Ayers ran the "violent left wing activist group" called Weather Underground.

We know Ayers' wife was on the FBI's 10 Most Wanted list.

We know they bombed the Capitol. The Pentagon. A judge's home.

We know Ayers said, "I don't regret setting bombs. .... I feel we didn't do enough."

But Obama's friendship with terrorist Ayers isn't the issue.

The issue is Barack Obama's judgment and candor.

When Obama just says, "This is a guy who lives in my neighborhood."

Americans say, "Where's the truth, Barack?"

Barack Obama. Too risky for America.

JOHN MCCAIN: I'm John McCain and I approve this message.

AD FACTS: Script For "Ayers" (WEB :90)

ANNCR: Barack Obama and domestic terrorist Bill Ayers. Friends. They've worked together for years. But Obama tries to hide it. Why? Obama launched his political career in Ayers' living room.

Barack Obama's Relationship With Ayers "Went Much Deeper, Ran Much Longer And Was Much More Political Than Obama Said." CNN'S DREW GRIFFIN: "Barack Obama confirmed during a primary debate that he knew Ayers and when pressed, said they served on a charitable foundation board together. And Obama condemned Ayers support of violence. But the relationship between Obama and Ayers went much deeper, ran much longer, and was much more political than Obama said." (CNN's "Anderson Cooper 360," 10/6/08)

Barack Obama First Met William Ayers In 1995 During His First State Senate Campaign, When Obama Held Event At Home Of Ayers And Wife Bernardine Dohrn, Which One Attendee Said Was Aimed At "Launching Him" In First Campaign For State Senate. "In 1995, State Senator Alice Palmer introduced her chosen successor, Barack Obama, to a few of the district's influential liberals at the home of two well known figures on the local left: William Ayers and Bernardine Dohrn. While Ayers and Dohrn may be thought of in Hyde Park as local activists, they're better known nationally as two of the most notorious -- and unrepentant -- figures from the violent fringe of the 1960s anti-war movement. ... 'I can remember being one of a small group of people who came to Bill Ayers' house to learn that Alice Palmer was stepping down from the senate and running for Congress,' said Dr. Quentin Young, a prominent Chicago physician and advocate for single-payer health care, of the informal gathering at the home of Ayers and his wife, Dohrn. '[Palmer] identified [Obama] as her successor.' ... Dr. Young and another guest, Maria Warren, described it similarly: as an introduction to Hyde Park liberals of the handpicked successor to Palmer, a well-regarded figure on the left. 'When I first met Barack Obama, he was giving a standard, innocuous little talk in the living room of those two legends-in-their-own-minds, Bill Ayers and Bernardine Dohrn,' Warren wrote on her blog in 2005. 'They were launching him -- introducing him to the Hyde Park community as the best thing since sliced bread.'" (Ben Smith, "Obama Once Visited '60s Radicals," The Politico, 1/22/08)

CNN: The Meeting Was Widely Considered As "Barack Obama's Political Coming Out Party And It Was Hosted By Bill Ayers." CNN'S DREW GRIFFIN: "Anderson, this meeting at Bill Ayers home has been classified in many different ways. What I can tell you from the two people who were actually there, is number one, former Senator Alice Palmer says she, in no way organized this meeting and she was invited and attended it briefly. And Doctor Quentin Young, a retired doctor, told us this indeed was Barack Obama's political coming out party and it was hosted by Bill Ayers." (CNN's "Anderson Cooper 360," 10/6/08)

ANNCR: Ayers and Obama ran a radical "education" foundation, together.

Barack Obama Led Education Foundation That "Poured More Than $100 Million Into The Hands Of Community Organizers And Radical Education Activists" And "Translated Mr. Ayers's Radicalism Into Practice." "Despite having authored two autobiographies, Barack Obama has never written about his most important executive experience. From 1995 to 1999, he led an education foundation called the Chicago Annenberg Challenge (CAC), and remained on the board until 2001. The group poured more than $100 million into the hands of community organizers and radical education activists. ... The CAC's agenda flowed from Mr. Ayers's educational philosophy, which called for infusing students and their parents with a radical political commitment, and which downplayed achievement tests in favor of activism. In the mid-1960s, Mr. Ayers taught at a radical alternative school, and served as a community organizer in Cleveland's ghetto. ... CAC translated Mr . Ayers's radicalism into practice. Instead of funding schools directly, it required schools to affiliate with 'external partners,' which actually got the money. Proposals from groups focused on math/science achievement were turned down. Instead CAC disbursed money through various far-left community organizers, such as the Association of Community Organizations for Reform Now (or Acorn)." (Stanley Kurtz, Op-Ed, "Obama and Ayers Pushed Radicalism On Schools," The Wall Street Journal, 9/23/08)

From March Of 1995 Until September Of 1997, Barack Obama And Ayers Attended At Least Seven Meetings Together Relating To The Chicago Annenberg Challenge. (Chicago Annenberg Challenge, Board Of Directors Meeting, Minutes Of The Board, 3/15/95, 3/31/95, 4/13/95, 6/5/95, 9/30/97; National Annenberg Challenge Evaluation Meeting, List Of Participants, 5/24/95; Chicago Annenberg Challenge, Chicago School Reform Collaborative Meeting, Minutes, 10/23/96)

CNN: The Paths Of Barack Obama And Ayers "Repeatedly Crossed" At The Annenberg Challenge. CNN'S DREW GRIFFIN: "One place their paths repeatedly crossed, according to a CNN review of board minutes and other records, was Chicago's Annenberg Challenge project where a $50 million grant from the Annenberg Foundation matched locally raised funds to improve schools. According to participants and project records, Bill Ayers fought to bring the Annenberg grant to Chicago, Barack Obama was recruited as its chair. For seven years, Bill Ayers and Obama among many others, worked on funding for education projects, including some experiments supported by Ayers." (CNN's "Anderson Cooper 360," 10/6/08)

ANNCR: They wrote the foundation's by-laws, together.

Barack Obama "Served On The Board's Governance Committee With Mr. Obama, And Worked With Him To Craft CAC Bylaws." "The Daley documents show that Mr. Ayers sat as an ex-officio member of the board Mr. Obama chaired through CAC's first year. He also served on the board's governance committee with Mr. Obama, and worked with him to craft CAC bylaws. Mr. Ayers made presentations to board meetings chaired by Mr. Obama. Mr. Ayers spoke for the Collaborative before the board. Likewise, Mr. Obama periodically spoke for the board at meetings of the Collaborative." (Stanley Kurtz, Op-Ed, "Obama and Ayers Pushed Radicalism On Schools," The Wall Street Journal, 9/23/08)

Bill Ayers Was Asked To Help Barack Obama Formulate The Chicago Annenberg Challenge By-Laws. (Chicago Annenberg Challenge Board Of Directors Minutes, 3/15/95)

ANNCR: Obama was the foundation's first chairman.

Barack Obama "Was The First Chairman Of The Chicago Annenberg Challenge." "In the 1990s, Ayers was instrumental in starting the Chicago Annenberg Challenge, which was awarded nearly $50 million by a foundation to help reform Chicago schools. Obama was the first chairman of the Chicago Annenberg Challenge and Republicans have been highlighting his ties to Ayers through the group." (Pete Yost, "University Won't Open Obama-Related Records Now," The Associated Press, 8/19/08)

ANNCR: Reports say they, "distributed more than $100 million to ideological allies with no discernible improvement in education."

Chicago Annenberg Challenge: "Distributed More Than $100 Million To Ideological Allies With No Discernible Improvement In Public Education." "With Ayers directing the project's operational arm and Obama overseeing its financial affairs until 1999, the Chicago Annenberg Challenge distributed more than $100 million to ideological allies with no discernible improvement in public education." (Editorial, "Obama's Friend, America's Enemy," National Review, 8/27/08)

ANNCR: When their relationship became an issue, Obama just responded, "This is a guy who lives in my neighborhood." That's it?

Barack Obama On Ayers At Democratic Debate: "This Is A Guy Who Lives In My Neighborhood." "This is a guy who lives in my neighborhood, who's a professor of English in Chicago, who I know and who I have not received some official endorsement from. He's not somebody who I exchange ideas from on a regular basis." (Sen. Barack Obama, ABC Democratic Presidential Debate, Philadelphia, PA, 4/16/08)

ANNCR: We know Bill Ayers ran the "violent left wing activist group" called Weather Underground.

Bill Ayers Was A Leader Of "The Violent Left-Wing Activist Group The Weather Underground." "Senator Obama's ties to a former leader of the violent left-wing activist group the Weather Underground are drawing new scrutiny as he battles Senator Clinton for the Democratic presidential nomination." (Russell Berman, "Obama's Ties to Left Come Under Scrutiny," The New York Sun, 2/19/08)

ANNCR: We know Ayers' wife was on the FBI's 10 Most Wanted list.

Bill Ayers' Wife, Weather Underground Leader Bernardine Dohrn, Appeared On FBI's "Most Wanted" List. "Bernardine Dohrn, the former leader of the militant Weather Underground who turned herself in after 11 years on the run, says she looks forward to spending time with family and friends and intends to continue a rebellion against 'the system.' ... 'I remain committed to the struggle ahead,' Ms. Dohrn told reporters Wednesday after a court appearance. 'Given the system which perpetuates ... harsh oppression and suffering, rebellion is inevitable and continuous.' Ms. Dohrn, 38, pleaded innocent to nine charges -- seven stemming from the 1969 'Days of Rage' anti-war demonstration in Chicago and two more for jumping bail. She was released on $25,000 bond and a hearing was set for Jan. 13. Ms. Dohrn, who once appeared on the FBI's most-wanted list, arrived in court with a lawyer and William Ayers, another ex-radical who said he lived with Ms. Dohrn in New York and is the father of her two children." (James Litke, "Fugitive Leader Surrenders With No Regrets," The Associated Press, 12/4/80)

ANNCR: We know they bombed the Capitol. The Pentagon. A judge's home.

In The 1970s, Weather Underground Bombed The Capitol And The Pentagon. "As an Illinois state senator in 2001, Mr. Obama accepted a $200 contribution from William Ayers, a founding member of the group that bombed the U.S. Capitol and the Pentagon during the 1970s." (Russell Berman, "Obama's Ties to Left Come Under Scrutiny," The New York Sun, 2/19/08)

New York State Supreme Court Justice's House Was Bombed By Weather Underground. "In February 1970, my father, a New York State Supreme Court justice, was presiding over the trial of the so-called "Panther 21," members of the Black Panther Party indicted in a plot to bomb New York landmarks and department stores. Early on the morning of February 21, as my family slept, three gasoline-filled firebombs exploded at our home on the northern tip of Manhattan, two at the front door and the third tucked neatly under the gas tank of the family car. (Today, of course, we'd call that a car bomb.) A neighbor heard the first two blasts and, with the remains of a snowman I had built a few days earlier, managed to douse the flames beneath the car. That was an act whose courage I fully appreciated only as an adult, an act that doubtless saved multiple lives that night. ... Though no one was ever caught or tried for the attempt on my family's life , there was never any doubt who was behind it. Only a few weeks after the attack, the New York contingent of the Weathermen blew themselves up making more bombs in a Greenwich Village townhouse. The same cell had bombed my house, writes Ron Jacobs in The Way the Wind Blew: A History of the Weather Underground. And in late November that year, a letter to the Associated Press signed by Bernardine Dohrn, Ayers's wife, promised more bombings." (John M. Murtagh, "Fire In The Night," City Journal, 4/30/08)

In His Book, Bill Ayers Writes About Participating In The Bombings Of The Capitol And Pentagon. "Now he has written a book, 'Fugitive Days' (Beacon Press, September). Mr. Ayers, who is 56, calls it a memoir, somewhat coyly perhaps, since he also says some of it is fiction. He writes that he participated in the bombings of New York City Police Headquarters in 1970, of the Capitol building in 1971, the Pentagon in 1972." (Dinitia Smith, "No Regrets For A Love Of Explosives," The New York Times, 9/11/01)

ANNCR: We know Ayers said, "I don't regret setting bombs. . I feel we didn't do enough."

In The September 11, 2001 New York Times, Ayers Was Quoted Saying "I Don't Regret Setting Bombs ... I Feel We Didn't Do Enough." "'I don't regret setting bombs,' Bill Ayers said. 'I feel we didn't do enough.' Mr. Ayers, who spent the 1970's as a fugitive in the Weather Underground, was sitting in the kitchen of his big turn-of-the-19th-century stone house in the Hyde Park district of Chicago." (Dinitia Smith, "No Regrets For A Love Of Explosives," The New York Times, 9/11/01)

ANNCR: But Obama's friendship with terrorist Ayers isn't the issue. The issue is Barack Obama's judgment and candor. When Obama just says, "This is a guy who lives in my neighborhood." Americans say, "Where's the truth, Barack?" Barack Obama. Too risky for America. JOHN MCCAIN: I'm John McCain and I approve this message.

Barack Obama On Ayers At Democratic Debate: "This Is A Guy Who Lives In My Neighborhood." "This is a guy who lives in my neighborhood, who's a professor of English in Chicago, who I know and who I have not received some official endorsement from. He's not somebody who I exchange ideas from on a regular basis." (Sen. Barack Obama, ABC Democratic Presidential Debate, Philadelphia, PA, 4/16/08)

Tags:

Barack Obama or

John McCain and

Sarah Palin