H. Con. Res. 34, the Fiscal Year 2012 Budget Resolution, passed the House by a vote of 235 - 193

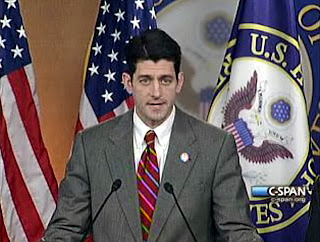

House Budget Committee Chairman Paul Ryan issued the following remarks on the House floor in advance of the historic vote:

“We must choose this path. We must not be the Congress that failed to fulfill the American legacy of leaving a better nation to our children.

“We must not leave this nation in decline. We must not be the first generation in this country to leave the next generation worse off.

“Decline is antithetical to the American Idea. America is a nation conceived in liberty, dedicated to equality, and defined by limitless opportunity. Equal opportunity, upward mobility, prosperity – this is what America is all about.

“In all the chapters of human history, there has never been anything quite like America. This budget keeps America exceptional, and preserves its promise for the next generation.

“Colleagues: This is our defining moment. We must choose this path to prosperity.”

Key facts about the House-passed Fiscal Year 2012 Budget Resolution – The Path to Prosperity:

SPENDING

* Cuts $6.2 trillion in government spending over the next decade compared to the President’s budget.

* Eliminates hundreds of duplicative programs, reflects the ban on earmarks, and curbs corporate welfare bringing non-security discretionary spending to below 2008 levels.

DEBT AND DEFICITS

* Reduces deficits by $4.4 trillion compared to the President’s budget over the next decade.

* Puts the budget on the path to balance and pays off the debt.

TAXES

* Keeps taxes low so the economy can grow. Eliminates roughly $800 billion in tax increases imposed by the President’s health care law. Prevents the $1.5 trillion tax increase called for in the President’s budget.

* Calls for a simpler, less burdensome tax code. Lowers tax rates for individuals, businesses and families. Improves incentives for growth, savings, and investment.

GROWTH AND JOBS

* Creates nearly 1 million new private-sector jobs next year and results in 2.5 million additional private-sector jobs in the last year of the decade.

Unleashes prosperity and economic security, yielding $1.1 trillion in higher wages and an average $1,000 per year in higher income for each family.

IMAGE CREDIT: c-span.org

TEXT CREDIT: Committee on the Budget: U.S. House of Representatives 207 Cannon House Office Building, Washington, DC 20515

No comments:

Post a Comment