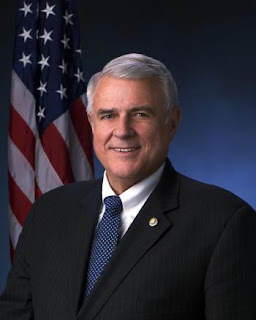

| U.S. Congressman Mike Pence delivered remarks on the economy at 12:45pm ET to the Detroit Economic Club. His remarks, as prepared for delivery, are included below:

“Thank you L. Brooks Patterson for that kind introduction and heartfelt thanks to Beth Chappell and all the members of the Detroit Economic Club for hosting me. |

For 75 years, the Detroit Economic Club has been a premier venue for leaders interested in saying something significant about our economy and I am genuinely grateful to be able to join the ranks of those who had the privilege to “say it here.”

“And it's great to be in Detroit- home to Motown, the Lions (you know who this Colts fan was cheering for on Thanksgiving!) and the "Car Capitol of the World.”

“My father ran a chain of gas stations so, like most Americans, I have had a life long love affair with the automobile. Try to imagine America without the Ford Mustang, the Chevrolet Corvette, or the Dodge Charger.

“Being from Indiana, I am especially proud of the role that Hoosiers have played and continue to play in this unique American industry. And it all started here in Detroit. America owes a debt to the ingenuity and entrepreneurism of this great city. You helped define the character of a nation.

“But Detroit and America have seen better days and I come to this storied podium to say after years of runaway federal spending, borrowing and bailouts by both political parties, that there is a better way, a way we can renew American exceptionalism by returning to the principles and practices that built this great city and this great country and can build it again.

“We live in no ordinary times. Our economy is struggling in the city and on the farm. Unemployment is at a heartbreaking 9.6 percent nationally and nearly 13 percent in Michigan. Nearly 42 million Americans on food stamps. A housing crisis and dismal GDP growth.

“And it seems that those in authority have no idea what to do about it. Some in the administration call it the “new normal.” (like we haven’t heard that before) In the 70’s they called it a national “malaise.”

“With more than 15 million people still looking for work, President Obama and Democrats in Congress have tried to borrow and spend the country back to prosperity resulting in trillion dollar plus annual deficits and a nearly $14 trillion national debt. To this runaway federal spending they added a government takeover of health care, attempted a national energy tax and approved one bailout after another.

“In September 2008, when the Bush Administration proposed that Congress give them $700 billion to bail out Wall Street, I was the first Member of Congress to publicly oppose it. I didn't think we should do nothing, I just thought it was wrong to take $700 billion from Main Street to bailout bad decisions on Wall Street. I warned that passing TARP could fundamentally change the relationship between the government and the financial sector and so it has.

“Dodd-Frank codified “too big to fail" for some Wall Street firms and made taxpayers the first line of defense against failure. And we continue to bailout Fannie and Freddie to the tune of about $150 billion, with more expected, despite the fact that many of us have been fighting for years to get them off the government’s books. The partnership between the federal government and Fannie and Freddie socializes losses and privatizes profits with taxpayers getting the short end of the stick.

“And, even though I am proud of the American automotive tradition and Indiana’s ongoing role it, I even opposed bailing out GM and Chrysler. While the administration has been busy making the point that GM is on the rebound and taxpayers are being repaid, most Americans know that it still would have been better if GM had gone through an orderly reorganization bankruptcy without taxpayer support.

“Taxpayer funded bailouts are no substitute for economic policies that will create real consumer demand. I have no doubt that American automakers and autoworkers can compete and win in a growing American economy.

“To restore American exceptionalism, we must end all this Keynesian spending and get back to the practice of free market economics. The freedom to succeed must include the freedom to fail. The free market is what made America’s economy the greatest in the world, and we cannot falter in our willingness to defend it.

“Even though our economy is struggling and America seems at a low point, I believe we can restore our economy but it will take vision and courage to do it. And everything starts with putting our fiscal house in order.

“The good news is there is no shortage of plans for fiscal discipline in Washington these days. We have the Pledge to America, the president’s Debt Commission, and over time we’ve had budgets, blueprints, outlines, and thoughtful proposals from Members of Congress, and blue-ribbon panels.

“For my part, I believe the answer is a Spending Limit Amendment to the Constitution. Since World War II the federal government has operated on an average of just under 20 percent of gross domestic product. But, in the past three years, federal spending has climbed to nearly 25 percent of GDP. Left unchecked, and accounting for no new programs, federal spending will reach 50 percent of GDP by 2055.

“We should remember what Ronald Reagan said, “No government ever voluntarily reduces itself in size.” We must have a mechanism that forces Washington as a whole to make the hard choices necessary to reform our nation’s addiction to big spending and unsustainable entitlements.

“By limiting federal spending to 20 percent of our nation’s economy in the Constitution, except for certain conditions such as a war, we will create a framework for this and future Congresses to live within our means and have the incentive to grow the economy.

“To grow the economy we must shrink the size of the federal government but fiscal discipline alone will not be enough to bring jobs and prosperity back to America.

“We need a new agenda for economic growth and that is principally what brings me to Detroit to discuss today.

“As Margaret Thatcher said in equally challenging economic times (1977):

…Of course we’re not going to solve our problems just by cuts, just by restraint… it was not restraint that started the Industrial Revolution... It wasn’t restraint that inspired us to explore for oil in the North Sea and bring it ashore. It was incentive – positive, vital, driving, individual incentive.

“What was true for England in the 1970’s, is true for America today. Permitting people to enjoy the fruits of their labor is what built our cities, conquered our frontiers, and made America the most prosperous nation in the history of the world.

“The new Republican majority in Congress must embrace a bold agenda for economic growth built on timeless free market practices and reform.

“So what are the building blocks of an incentive-based, growth agenda? I submit they are the following:

▪ Sound monetary policy;

▪ Tax relief and reform;

▪ Access to American energy;

▪ Regulatory reform;

▪ Trade

““S.T.A.R.T.” You could call it a prescription for a fresh start for the American economy. Some of these are new ideas. Some are timeless. Taken together, they will put us back on track for job creation and prosperity.”

Sound Monetary Policy and a Restoration of Free Market Principles

“Sound monetary policy is the foundation of our prosperity. A strong dollar means a strong America.

“The American people know we cannot borrow and spend our way back to a growing America and sent a deafening message of restraint to Washington D.C. on November 2nd. But it doesn't look like the administration got the message and neither did the Federal Reserve.

“During 2008 and 2009, the Fed pushed well over $1 trillion into the financial system in an attempt to rein in unemployment through more government stimulus, yet the national jobless rate has been well above 9 percent for a record-tying 18 straight months. The Fed's second and latest round of "quantitative easing," known as QE2, actually seeks inflation in an effort to bring down unemployment. Printing money is no substitute for sound fiscal policy. And while there is no guarantee that this policy will succeed in reducing unemployment, it is near certain that the value of the dollar will be diluted. As economist Larry Kudlow says, “the Fed can print more money, but it can’t print jobs.”

“I do not lay the blame solely at the feet of the Federal Reserve. The problem for the Fed began in 1977 when Congress imposed a dual mandate, which requires that the central bank pursue price stability and maximum employment in executing its policies. Too often, this conflicting mandate has pit short-term hopes for job gains against long-term costs to the economy. QE2 is an example of what happens when the Fed involves itself too much in macroeconomic meddling.

“A couple weeks ago, I introduced legislation to end the dual mandate and return the Fed to its original, single mandate – price stability. Treasury Secretary Timothy Geithner recently said the administration will oppose any effort to end the dual mandate arguing that it was “very important to keep politics out of monetary policy”. But Congress created the dual mandate in 1977 and getting the Fed back to its original mission of price stability is precisely how we get politics out of monetary policy.

“It's time that the Federal Reserve focus exclusively on price stability and protecting the dollar. And it’s also time that policymakers in Washington D.C. embrace the kind of reforms that will promote real growth.

“Before I move on, I would like to note that in the midst of all that has happened recently – massive government borrowing and spending, quantitative easing – a debate is starting anew over an anchor for the global monetary system.

“My dear friend, the late Jack Kemp probably would have urged me to adopt a gold standard here and now. Robert Zoellick, President of the World Bank, encouraged that we re-think the international currency system, including the role of gold and I agree. The time has come to have a debate over gold and the proper role it should play in our nation’s monetary affairs.”

Tax Relief and Reform: Flat Tax

“The first principle of a tax system in a free society must be certainty. Uncertainty is the enemy of our prosperity. For too long on tax policy, uncertainty has been the order of the day.

“To end the uncertainty that is stifling investment, innovation and growth, we must preserve current tax rates and promote permanent tax reform.

“For starters, of course, Congress must permanently extend the 2001 and 2003 tax rates to ensure no American faces a tax hike on January 1st, and I have introduced a bill with Sen. Jim DeMint to do just that. Most Americans know that higher taxes won't get anybody hired. Raising taxes on job creators won't create jobs.

“But, preventing a tax increase is not enough. If the current tax rates were sufficient to get this economy moving again, it would be and it’s not.

“The time has come for Congress and this administration to take bold action to simplify our tax system and lower people’s taxes.

“The tax code has grown too large and complex. It has 3.8 million words. The forms are dizzying. And nothing about it seems fair.

“People are taxed on their income. Then after they pay their bills, they take the leftover money and put it into savings or an investment. If their savings or investments make any money, they are taxed again. If they buy stock in a company, the company pays taxes on its profits. Then it takes those profits and provides a dividend to shareholders and it is taxed again. The final outrage occurs at death, when your estate pays taxes once again on all the money you’d previously paid taxes on while living.

“All I really know about economics is what you tax you get less of and what you subsidize you get more of. We need a tax system that will encourage income, savings, investment and growth, but our tax code does the opposite. It punishes savers and investors by taxing them twice and in some cases more times than that.

“To promote income, savings and investment, we need a system built on the principle that income should be taxed once and just once. We need a fair and effective method of taxation that will make doing your taxes easy and remove the confusion of the present tax code.

“In an upcoming study written by the legendary Dr. Art Laffer, Wayne Winegarden and John Childs, they found the cost of compliance with today’s tax code to be over $540 billion annually and that individuals and businesses spend 7.6 billion hours on their taxes.

“Just imagine if Americans were putting that time and money into enjoying their lives or growing their businesses. The Laffer study predicts that by simplifying the tax code and cutting complexity costs in half, our economy would grow $1.3 trillion more over ten years than if we maintain the status quo. That means each person in this country would be approximately $4,200 wealthier. And that’s just from simplifying our tax code by half.

“But we can do better than that. How about a system where could file your taxes on a Blackberry, or a system where you might even be able to file a return with 140 characters or less? How would you like to tweet your taxes?

“We can create a twenty-first century American tax system that will provide government with the revenue it needs without discouraging growth or placing an undue burden of compliance on our citizens.

“There is one system that meets all of these criteria: the best option, the most pro-growth option is a flat tax. I believe it is time that America adopted a flat tax and scrapped the current system once and for all.

“A flat tax would release enormous amounts of capital into the system, and it would operate under a simple principle: what you take out of the economy is taxed, like wages and business income, and what you put into the economy is not, like savings and investments.

“Individuals and businesses would pay taxes at the same rate. Individuals would pay taxes on their wages or salary after receiving a basic income exemption and an exemption for any dependents, including children and elderly family members and others who you care for in your home. Imagine how easy this would be for people. Gross income minus a generous standard deduction minus any dependent exemptions and you’ve got your taxable income. Apply the rate and your taxes are done. Everyone pays the same rate, and the more money you make, the more you pay. It’s fair, simple and effective.

“If you are a business, you pay tax on your gross income for the year minus one hundred percent of your expenses: rent, wages, fuel, supplies, etc. Depreciation is no longer necessary because the entire cost of investment spending can be deducted in one year.

“The flat tax eliminates all of the credits and deductions and special preferences and tax loopholes that Congress and an army of lobbyists have built into the tax code over time. These fuel special interests and generally benefit one person, business or industry over another. Our tax system should not pick winners and losers, but should treat every business, small and large, with the same basic rules.

“Instead, everyone would be on a level playing field with certainty as to your taxes. A taxpayer would either subtract his basic and dependent exemptions or business expenses and end up with taxable income. It would reduce compliance costs by hundreds of billions of dollars.

“Following the principle of only taxing once, it eliminates the AMT, the capital gains and dividends taxes, and the death and gift taxes.

“And this is hardly radical. A flat tax is in use in more than twenty countries around the world, and they have been proposed and supported by various legislators and economists in America over the past 30 years, such as Robert Hall and Alvin Rabushka, Dick Armey, Steve Forbes, Art Laffer, Jack Kemp and Richard Gephardt. We don’t think about it, but we already use flat taxes in America as taxes for Social Security, Medicare taxes, sales and property taxes.

“It may come as a surprise to many, but even the New York Times wrote favorably about a flat tax saying, “…every dollar of income would be taxed once and only once. The plan would subsidize saving, and create an exemption that would protect the poor. [I]t is perfectly simple.” The Gray Lady was right.

“And a flat tax will make America more globally competitive. New York City is still the financial capital of the world, but for how long will that be true? The Wall Street Journal recently reported that in New York City in 2011, the combined federal and state tax rate will be nearly 54 percent. With government taking more than half of your money, is that an incentive to work hard or to take your business elsewhere?

“A global economy means New York is now competing to keep businesses and capital from moving to Beijing or Bangalore. Right now, our corporate tax rate is 15 points higher than the rest of the world. And more than twenty countries with growing economies have a flat tax in place for businesses and individuals.

“Hong Kong instituted its flat tax in 1947 and has no tax on capital gains or dividends. Its tax code is short, to the point, and effective, and Hong Kong is a wealthy, thriving city with a growing economy and government surpluses. Russia, Czech Republic, and Ukraine all have flat taxes. The hard truth is the future is flat. The world is going flat everywhere but in America, and to lead the next American century, our nation needs to lead in capital formation and tax reform again.

“And a flat tax will mean jobs. According to one study by the Heritage Foundation, the flat tax would result in tremendous economic growth with GDP potentially growing by as much as 7 percent within 3 years and nearly 1.5 million jobs being created.

“Not that this should come as a surprise. If you look back at history, the Kennedy, Reagan and 2001/2003 tax reforms were all followed by strong economic growth. The flat tax goes beyond these tax cuts and provides not just lower taxes but a greatly simplified system.

“After the Kennedy tax cuts, the top rate went from 91 percent to 70 percent. Economic growth soared: unemployment went down by more than 2 percent and tax receipts increased by 33 percent.

“Two decades later, President Reagan’s across-the-board tax cuts brought America back from a devastating recession. In 1981, unemployment was at 7.6 percent nationally. The Dow Jones was at 777. Mortgage interest rates were over 20 percent. By 1987, the prime rate was down to 8.2 percent. The Dow was up to 3,000 by the end of Reagan’s term, and 17 million new jobs were created. That’s real growth. It created true opportunity and improved the lives of average Americans.

“And after the 2001 and 2003 Bush tax cuts, the economy again grew, as did government revenues by $785 billion from 2004 to 2007, a record. There is an indisputable historical case to be made that tax relief and reform creates jobs and incentivizes growth in our economy.”

American Energy

“A source of American greatness observed since our founding has been our abundant natural resources. As Daniel Webster said, in words inscribed in the chamber of the House of Representatives:

Let us develop the resources of our land, call forth its powers, build up its institutions, promote all its great interests and see whether we also in our day and generation may not perform something worthy to be remembered.

“A policy for developing American energy must be a component of any plan for growth. We must embrace an all-of-the-above energy policy that promotes energy independence in an environmentally responsible manner. An all-of-the-above energy policy should not mean subsidizing all-of-the-above. It means allowing all types of energy to be developed and compete honestly in a free marketplace.

“We can and should wisely use these resources to better the lives of our citizens. Our environment can be protected while we increase energy production, encourage greater efficiency and conservation, and promote the development and use of alternative fuels, and innovative new technologies like we’re seeing developed right here in Detroit.

“It also is time for a nuclear energy renaissance in America. The regulatory process for new applications can be accelerated, and we can safely store and recycle spent nuclear fuel. Nuclear energy not only means a source of clean emissions-free energy; it also means construction jobs, manufacturing jobs, and science-based economic growth.

“Developing our own sources of energy here at home will provide certainty about our future, ensure that energy remains affordable and create jobs.”

Regulatory Relief and Reform

“Next, to restore incentive and encourage growth we must reduce the regulatory burden on our economy. There is a place for regulations that ensure safety and soundness and protect people from danger, but our regulatory structure has grown out of control.

“Today we have too many regulations and too many regulatory authorities that have expanded the reach of the federal government too far. These regulations add billions to the cost of doing business and in their wake they kill jobs.

“Take the requirement from ObamaCare that businesses must file with the IRS a form 1099 for any purchases from a vendor for goods or services over $600 in a year. Seriously, that is in the law. Of course, this is ridiculously burdensome and just adds to the red tape that small businesses face across the country. It should be repealed immediately.

“According to the Small Business Administration, the average small business faces a cost of $10,585 in federal regulations per employee each year. These small employers represent 99.7 percent of all businesses and have created 64 percent of all new jobs over the past 15 years.

“Imagine if small businesses could put the $10,000 per employee they spend each year on federal regulations directly back into new jobs.

“Ronald Reagan once said “A government bureau is the nearest thing to eternal life we'll ever see on this earth.” It’s time to change that, at least when it comes to regulations.

“I propose that any existing regulation with an economic impact of $100 million or more must be reviewed and if still necessary, re-promulgated every ten years to allow for public comment and a reassessment of the cost of the regulation. Instead of eternal life, these regulations will get ten years.

“After ten years, there is no reason not to review, modernize, improve and reduce the cost of existing regulations.

“Further, I believe that all new regulations that impose an economic cost on families, businesses or local governments should be subject to a regulatory “paygo” procedure before implementation. If government wants to issue a new regulation that is going to impose an economic cost, then it needs to reduce another regulatory burden elsewhere so that there is no new burden on the economy.

“Some regulations, and some bills that have passed Congress, however, impose costs that are too great and can never be offset and must be repealed.

“ObamaCare, Dodd-Frank, TARP, and Section 404 of Sarbanes-Oxley fall in that category. Also, Congress must override the EPA’s endangerment finding so that regulatory cap and trade cannot be forced on the American people against their will.”

Increased Trade

“As most Americans know, trade means jobs, and that is especially true in places like Indiana and Michigan where we grow food that the world consumes and make cars and other products that are used around the globe. Encouraging free trade lowers barriers to entry for our goods, and that in turn allows U.S. companies to create more jobs.

“Protectionism and closing our doors to other countries does not help us, or people in the rest of the world. We must support expanded free trade to renew American exceptionalism and create jobs.

“Despite the president’s stated objective of doubling American exports in the next five years, trade has largely been ignored by Democrats in Congress and the administration in recent years. With a new Republican majority in the House, I am hopeful that the free trade agreements with Panama, Colombia and South Korea can move forward. We need to get those deals done, and done right, but it should not end there. We must promote increased trade at every opportunity around the world. When the world “buys American,” Americans go to work.”

Renewing the Character of the Nation

“Finally, to renew American exceptionalism, we must recognize that our present crisis is not merely economic but moral in nature. At the root of these times should be the realization that people in positions of authority from Washington to Wall Street have walked away from the timeless truths of honesty, integrity, an honest day's work for an honest day's pay and the simple notion that you ought to treat the other guy the way you want to be treated.

“As strongly as I believe in the economic policies in this address, I know we will not restore this nation with public policy alone. It will require public virtue. ‘When the foundations are being destroyed, what can the righteous do?’ As we promote policies to restore American exceptionalism, we must also reaffirm our nation’s commitment to the values that have made our prosperity possible. As we seek to build national wealth, we must renew our commitment to the institutions that nurture the character of our people- traditional family and religion.”

Conclusion.

“In 1977, my brother and I went backpacking through Europe and found our way to West Berlin. I will never forget the day I walked past the barbed wire and tank traps that barricaded the Berlin Wall, passed through security at Checkpoint Charlie and took my first steps into a wider understanding of the world.

“Standing in West Berlin I saw the energy, bustling streets and glass towers of a big city built on freedom and free market economics. The strassen were filled with stores, people, and bustling commerce.

“When we crossed through Checkpoint Charlie, past the harsh glare of uniformed East German guards, everything changed. The excitement and energy of West Berlin gave way to the dour reality of Soviet controlled East Berlin.

“The buildings were drab – concrete block tenement structures. Damage from World War II was still evident in many buildings. The cars were vintage 1950’s and people all seemed to be wearing the same colorless apparel. It was a gray, harsh reality.

“In that moment, I saw the difference between East and West, between a free market economy and a planned economy run by the state. Freedom and personal responsibility contrasted with socialism and decline.

“The problem with our economy today is that, after years of runaway spending and growth of government under both political parties, America is on that wall between West and East. No longer the vibrant free market that built cities like Detroit but not yet overtaken by the policies that have engulfed Europe in a sea of debt and mediocrity.

“To restore American economic exceptionalism, we have to decide that we believe in it again and turn and pursue a free market economy again with all our hearts.

“We have to choose. Ronald Reagan said it best

You and I are told we must choose between a left or right, but I suggest there is no such thing as a left or right. There is only an up or down. Up to man's age-old dream--the maximum of individual freedom consistent with order -- or down to the ant heap of totalitarianism.

“I choose the West. I choose limited government and freedom. I choose the free market, personal responsibility and equality of opportunity. I choose fiscal restraint, sound money, a flat tax, regulatory reform, American energy, expanded trade and a return to traditional values.

“In a word, I choose a boundless American future built on the timeless ideals of the American people. I believe the American people are ready for this choice and await men and women who will lead us back to that future, back to the West, back to American exceptionalism. Here’s to that future. Our best days are yet to come. Thank you.”

TEXT and IMAGE CREDIT:

Congressman Mike Pence Washington D.C. Office 1431 Longworth HOB Washington, DC 20515 (p) 202 225-3021 (f) 202 225-3382